Supply Chain Crunch: Why Operating Ports 24/7 is Still Problematic

Structural changes buoyed by a Direct Carrier Network offers a compelling solution

It doesn’t have to be this way.

With all the recent headlines blaring about jam-packed ports and supply chain Armageddon, one of the fundamental problems still lies with how we ship all these goods and transport them once they reach land. The critical ports of Los Angeles and Long Beach, which handle 40% of the incoming container ships in the US, are just now making incremental progress in offloading the hundreds of thousands of containers still sitting on cargo ships anchored just beyond the docks. In an effort to “catch up,” the ports are now operating on a 24/7 schedule.

There’s plenty of finger-pointing as to what or who is to blame for the gridlock. Many are finding fault with the trucking industry and its perceived lack of capacity and available drivers to haul all those containers.

But is this accurate?

Is Trucking to Blame? Yes and No.

Trucking represents just one grinding gear in the dysfunctional machine that is the national and global supply chain. But there’s justified pushback to the widely disseminated talking point that a driver shortage is largely to blame for the gridlock.

“First and foremost, there is no national shortage of truck drivers. That’s false,” argued Lewie Pugh, Vice President of the Owner-Operator Independent Drivers Association (OOIDA) during a recent podcast with Glenn Beck . “There’s a turnover problem in trucking. There’s a retention problem in trucking, but there is no driver shortage.”

Pugh went on to say a 24/7 model won’t solve many problems truckers face, pointing out there’s no incentive for shippers and receivers to get trucks loaded or unloaded quickly because truck drivers are not paid for the time they are sitting. “Their time isn’t worth anything to anybody,” he said.

But that argument does not absolve the trucking industry of contributing to inefficiencies that led to this crisis.

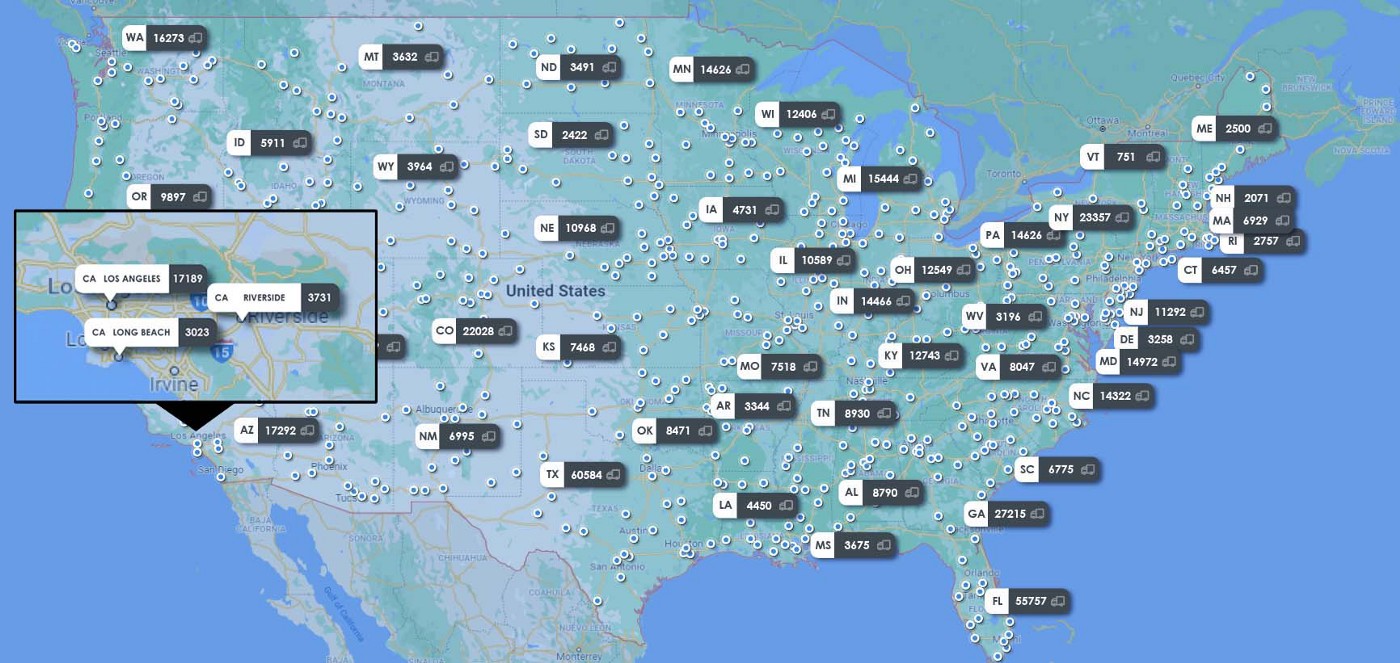

By most objective measures, the U.S. trucking industry is a chaotic, disorganized, technologically-deficient mess. Mega carriers that operate thousands of trucks are trying to shoulder the burden of moving all those containers — but mega carriers only represent about 3% of the industry. 97% of U.S. trucking companies are small and independent, owning just a handful of trucks — most less than six, and in many cases just a single truck. But finding, connecting with, and dispatching these trucks to where they’re needed most has long been a challenge.

A Direct Network Solution

“The trucks and the drivers are out there and available,” argues Rick Burnett, CEO & Founder of. The LaneAxis Direct Freight Network“The real problem is one of network visibility — or more specifically a lack thereof. U.S. trucks drive more than 20 billion empty miles every year. More than 450,000 new commercial driver’s licenses are issued every year. The conclusion is simple: there is plenty of trucking capacity out there, but no network visibility to find it, especially in a short time frame.”

The LaneAxis Direct Network represents a complete paradigm shift in the way cargo can (and will) be moved on trucks. Powered by blockchain and artificial intelligence, the LaneAxis platform is geared toward fully engaging small carriers by arming them with technology and identifying real-time capacity when and where it is needed most — such as the ports of Los Angeles and Long Beach.

Working around the clock to alleviate the cargo gridlock is a positive step, but not a panacea. Many of the mega-carriers being recruited to the ports have existing contracts with numerous companies. These contracts must be honored, and even with thousands of trucks at their disposal, it’s a major stretch to presume these large trucking companies can handle all those loads. It’s virtually inevitable that large carriers will have to refuse load requests, especially off-hours and especially with drivers limited as to how long they can drive before taking a break.

So how can businesses move more products than their current capacity will allow?

LaneAxis, with its innovative Direct to Carrier SaaS platform, can provide an easy solution to alleviate capacity constraints. With the thousands of carriers on the LaneAxis network, shippers can quickly and easily access extra capacity of these carriers and do it even at a substantial cost savings.

Signup for shippers and carriers is free on the LaneAxis platform. This takes only minutes to do and will give shippers immediate access to carriers who bid on the loads through the mobile app or desktop portal. Shippers then select a carrier’s bid. All documentation is digitally and securely exchanged and validated between shipper and carrier. Also, the shipper has complete visibility of their loads from pickup to delivery and the ability to directly communicate with the carrier if an incident or route change occurs. All shipment documentation is stored on the blockchain for complete transparency, security and verifiable chain-of-custody.

Trucking has been stuck in outdated processes for decades, crippling the supply chain when it matters most. The LaneAxis Direct Network, backed by blockchain and patented tech, is the future — and that future is now.

Visit LaneAxis.com to learn more.

What is Warehouse Logistics? Warehouse logistics encompass the personnel, procedures,..

LaneAxis Remains a Huge Advocate for Sustainability Since its establishment..

[embed]https://www.youtube.com/watch?v=s8-hNjskwLM&t=1342s[/embed] In this episode of our LaneAxis podcast "Let's Be..

Transforming the future of an industry – any industry -..

Financial Times of England analyzed companies from Canada to South..